We are thrilled to share a comprehensive report offering valuable insights into the expenses associated with developing a condominium project in various locations throughout the Greater Toronto Area (GTA). Our goal is to provide you with essential information that will enable you to make informed decisions. We have analyzed the costs in the following areas:

1. Land Acquisition: In this section, we will investigate the factors that influence the cost of land acquisition in various parts of the GTA, including location, bachelorarbeit ghostwriting, zoning regulations, and land prices.

2. Hard Costs: This section will provide you with a detailed breakdown of the direct construction costs involved in the project, such as materials, labor, equipment, and permits. We will also highlight any specific ghostwriting deutschland or cost variations that may arise in different parts of the GTA.

3. Soft Costs: We understand that indirect costs associated with the development are often overlooked. Therefore, this section will explain the essential but usually underestimated costs such as architectural and engineering fees, legal expenses, insurance, financing costs, and marketing expenses.

4. Development Charges: Lastly, we will cover the rapid rise of development charges in the GTA and how they impact the overall project budget. We will provide examples and explain how these charges are calculated.

We believe that this report will serve as a valuable resource, providing you with a comprehensive understanding of the costs involved in developing a condominium ghostwriter seminararbeit in different areas of the GTA. Please do not hesitate to contact us if you have any questions or require further information.

Let’s examine each of these factors in detail to understand the reasons behind the rising costs and pricing of condominiums.

Land Value and Cost

The value of land in the Greater Toronto Area is a complex interplay of various factors, such as its location, economic strength, development potential, infrastructure, hausarbeiten schreiben lassen, market trends, government policies, and investor confidence. Understanding these factors is crucial for those involved in the real estate industry to navigate this intricate market and make informed decisions.

Overall, in the Greater Toronto Area, the estimated land-to-revenue ratio in 2023 was 7.0%, down from 7.5% in 2022. This metric has shown a decline in each of the last five years from a sample high of 12.5% in 2018.

In the ‘905 Area’, purchasers paid for land at 4.5% of revenue in 2023, the lowest level during this six-year period. The LRR was 5.1% in 2022 and 6.1% in 2021, with the sample high being 8.0% in 2019.

In the ‘416 Area’ in 2023, the average purchaser paid for land at 7.9% of the estimated revenue at closing, a decrease from the average LRR of 8.2% in 2022. The LRR has trended down each year of this sample period, from a 2018 high of 13.7%.

Earlier reports emphasised that the decline in land-to-revenue ratios could be attributed to a combination of escalating cost factors.

These factors included construction expenses, material inflation, increased government fees, anticipated tweaks in planning policies (such as inclusionary zoning, mandatory green features, and the growing up guidelines), and the higher/longer monthly mortgage obligations resulting from a surge in interest rates and prolonged approval timelines.

Summary Data on High-Density Land Transactions by Planning Status, Building Type, And Area by Year, Old Toronto, and All other Areas in GTA from Q4-2017 to Q4-2023

Hard Costs

The hard costs in terms of the number of storeys in a building would be as follows (per square feet pricing in GTA):

- Up to 12 storeys – $275 to 380

- 13-39 storeys – $285 – $370

- 40-60 storeys – $320 to $400

- 60+ storeys – $345 – $450

- The premium for high quality – $75 – $200

Surface Parking – $12 – $28

Freestanding Parking Garages (above grade) 140 to 210

Underground Parking Garages – $195 to $270

Source : Altus Group | Canadian Cost Guide 2023

All building costs include the above-grade scope of work only; complete with foundations. To calculate the total construction cost you need to also include the below grade scope of work.

Here is how the calculation is applied separately for above grade

40-storey office building in Toronto | 800,000 square feet above grade | 200,000 square feet below grade

Above grade 800,000 square feet x $440/square foot = $352 million

Below grade 200,000 square feet x $230/square foot = $46 million

Total $398 million

Let’s examine the different variables that can affect the final expenses of a building project.

To ensure accuracy, judgement factors should be used within the average range. This allows for proper consideration of various factors that may affect the outcome.

Schedule

Extent of site works

Location

Site restrictions

Design method

Type of contract Quality

Building shape, size, and height

Market conditions

User requirements

Topography and soil conditions

Procurement advantage of developer/contractor

Soft Costs

First of all, you might be wondering what soft costs are. Soft costs refer to any expenses associated with a building project that are not related to the site acquisition or construction cost.

- Architectural & Engineering

- Geo-Scientists

- Mortgage Brokerage Fees

- Marketing & Advertising

- Legal Fees

- Land transfer tax

- Contingency costs

- Professional fees

- Holding costs

- Building permits

- Parkland levy

- Survey fees

- Legal fees & Condo fees

- Insurance

- Warranty provisions

- Project management fees

- Office expenses

- Marketing & Advertising

- Occupancy expenses

- Interim financing

- Broker fees

- Administration fees

- Construction loans

- Contingency soft cost

The rapid increase in development charges needs to be addressed and monitored closely.

Development charges, also known as development levies or fees, are fees imposed by municipalities on new development projects. These charges are intended to cover the cost of infrastructure and services required to support the new development. In the Greater Toronto Area (GTA), development charges can vary widely depending on the specific municipality and the type of development.

Development charges typically cover costs related to:

- Infrastructure: This includes costs for roads, water supply systems, sewer systems, and stormwater management infrastructure.

- Services: Charges may also include costs for providing services such as fire protection, parks, recreational facilities, and public transit.

- Utilities: Some development charges may cover the cost of utilities such as electricity, gas, and telecommunications infrastructure.

- Environmental Impact: Charges may be imposed to mitigate the environmental impact of new developments, such as conservation efforts or environmental assessments.

The exact amount of development charges in the GTA can vary significantly depending on factors such as the size and type of development, the location within the municipality, and specific requirements set by the municipality’s development charge bylaws.

It’s important for developers and investors to consider development charges when planning new projects, as these fees can have a significant impact on overall project costs and feasibility. Working closely with municipal authorities and understanding the applicable development charge regulations is essential for navigating this aspect of real estate development in the GTA.

In recent years, these charges have risen rapidly in Toronto. They are now 80% higher than they were in 2018. And this fall the City will be phasing in another 46% increase over the next two years.

By 2024 the charge for a one-bedroom unit will be $52,367 as compared with $35,910 today. And for a two-bedroom unit, the charge will be $80,218, compared with $55,012 today (and $19,000 in 2015).

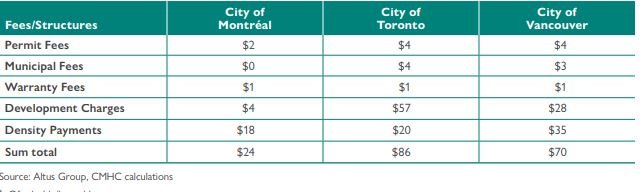

The July CMHC report indicates the average government charge per square foot in Toronto is $86 – compared to $70 in Vancouver and $24 in Montreal.

How does the builder determine the price per unit?

Here is a brief calculation of the cost of building a unit with parking and the price per square foot.

Hard Cost (Above Ground) = $350

Hard Cost – (Underground parking) = $200

Soft Cost = $100 – $150

Development Charges = $60 – $80

Land Price = $150 – $250

The construction cost to build a high rise will be between $900 and $1100 for a sq ft.

$350 + $200 + $200 + $150 = $900 per sq feet

This is just an estimated average, subject to variation based on market and project conditions.

Profitable condo development in the GTA requires understanding development costs to estimate unit costs and make informed decisions amidst strong demand and evolving trends.

Builders must show a minimum of 12% profit from the project and compete for 70% of the pre-sales to qualify for a construction loan from lenders. This is a general rule for builders, but it may vary depending on the market and project.

If you have any questions regarding the pricing of the condominium, please do not hesitate to contact us at info@condodevelopers.ca or call at 416-723-2525. Our analysis team will provide you with all the details about the price and an explanation. Investing in real estate is a life-changing decision, so choosing the right project at the correct price is crucial.

We would highly recommend downloading our Pre-Construciton Investment Guide for more details.

Source: Altus Group | Canadian Cost Guide 2023, CMHC report, Bulletin Consulting